All Categories

Featured

Table of Contents

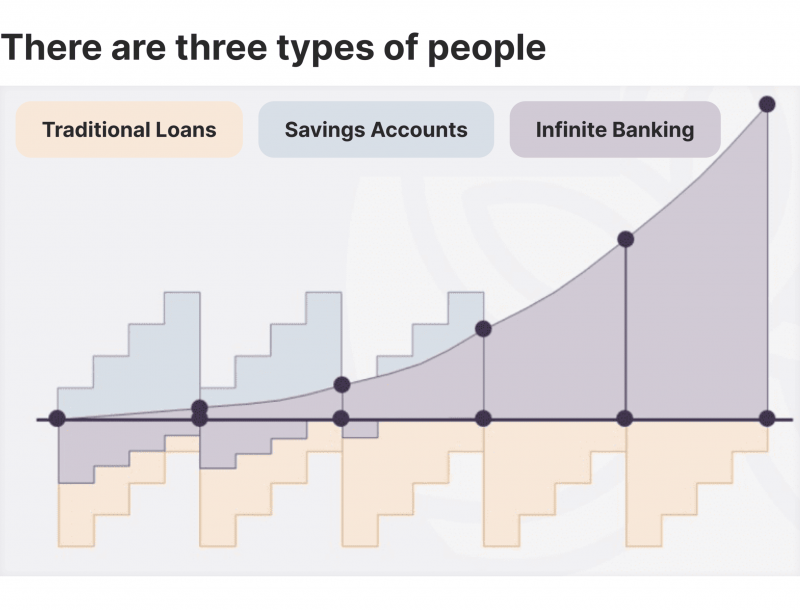

For many people, the biggest problem with the infinite banking principle is that preliminary hit to very early liquidity brought on by the costs. Although this con of limitless financial can be minimized substantially with correct plan design, the initial years will certainly always be the most awful years with any type of Whole Life policy.

That claimed, there are particular unlimited financial life insurance policy policies made mostly for high early cash worth (HECV) of over 90% in the initial year. The lasting efficiency will certainly usually considerably lag the best-performing Infinite Financial life insurance coverage policies. Having accessibility to that extra 4 figures in the first few years may come at the price of 6-figures in the future.

You actually obtain some significant long-term advantages that help you recoup these very early costs and after that some. We locate that this impeded very early liquidity problem with unlimited banking is a lot more mental than anything else when completely checked out. Actually, if they definitely needed every penny of the cash missing from their infinite financial life insurance policy in the very first few years.

Tag: limitless financial principle In this episode, I speak regarding funds with Mary Jo Irmen who educates the Infinite Banking Principle. With the increase of TikTok as an information-sharing platform, monetary advice and approaches have located an unique method of spreading. One such technique that has actually been making the rounds is the limitless financial concept, or IBC for short, gathering endorsements from stars like rap artist Waka Flocka Flame.

Within these plans, the money worth grows based on a rate established by the insurance firm. As soon as a significant cash worth collects, insurance holders can obtain a cash money value financing. These finances vary from standard ones, with life insurance policy functioning as security, meaning one might lose their protection if loaning excessively without sufficient money worth to support the insurance coverage expenses.

And while the attraction of these policies appears, there are inherent constraints and risks, requiring attentive cash money value tracking. The strategy's legitimacy isn't black and white. For high-net-worth people or organization proprietors, particularly those utilizing strategies like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound growth might be appealing.

Self Banking Whole Life Insurance

The appeal of limitless banking does not negate its obstacles: Cost: The fundamental demand, a long-term life insurance plan, is pricier than its term equivalents. Qualification: Not everyone certifies for entire life insurance policy as a result of rigorous underwriting processes that can leave out those with certain wellness or way of life conditions. Complexity and threat: The complex nature of IBC, combined with its risks, may prevent many, especially when simpler and much less risky alternatives are available.

Allocating around 10% of your month-to-month revenue to the plan is simply not feasible for the majority of individuals. Part of what you check out below is simply a reiteration of what has actually currently been claimed above.

Before you get yourself right into a situation you're not prepared for, recognize the following first: Although the principle is typically marketed as such, you're not really taking a lending from yourself. If that were the instance, you wouldn't need to repay it. Rather, you're borrowing from the insurance company and have to repay it with rate of interest.

Some social media sites articles advise making use of money value from whole life insurance policy to pay down bank card financial obligation. The concept is that when you pay off the funding with interest, the quantity will certainly be returned to your investments. However, that's not just how it works. When you repay the funding, a portion of that passion mosts likely to the insurer.

For the initial numerous years, you'll be paying off the payment. This makes it exceptionally tough for your plan to build up value throughout this time. Whole life insurance costs 5 to 15 times more than term insurance. Many people merely can't afford it. So, unless you can pay for to pay a couple of to several hundred bucks for the next decade or even more, IBC won't help you.

Dave Ramsey Infinite Banking Concept

If you call for life insurance policy, here are some important tips to think about: Take into consideration term life insurance coverage. Make certain to go shopping about for the finest rate.

Copyright (c) 2023, Intercom, Inc. () with Booked Font Style Name "Montserrat". This Font style Software is certified under the SIL Open Typeface Permit, Variation 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Booked Font Style Call "Montserrat". This Font style Software application is licensed under the SIL Open Font License, Variation 1.1.Miss to primary web content

Create Your Own Bank

As a CPA specializing in actual estate investing, I've cleaned shoulders with the "Infinite Financial Principle" (IBC) more times than I can count. I've also interviewed professionals on the topic. The major draw, in addition to the apparent life insurance policy advantages, was always the concept of building up cash money value within a long-term life insurance coverage policy and loaning versus it.

Sure, that makes sense. Honestly, I constantly believed that cash would certainly be better spent directly on investments rather than funneling it with a life insurance coverage policy Until I uncovered how IBC can be incorporated with an Irrevocable Life Insurance Policy Count On (ILIT) to create generational riches. Allow's start with the essentials.

The Infinite Banking Concept

When you borrow against your plan's cash money worth, there's no set payment routine, providing you the flexibility to take care of the funding on your terms. At the same time, the money value remains to grow based on the plan's assurances and returns. This arrangement allows you to access liquidity without interrupting the long-term growth of your policy, supplied that the financing and passion are managed carefully.

As grandchildren are birthed and grow up, the ILIT can acquire life insurance coverage plans on their lives. Household participants can take finances from the ILIT, utilizing the money value of the policies to money investments, begin organizations, or cover major costs.

A vital element of handling this Family Bank is the use of the HEMS standard, which represents "Health and wellness, Education And Learning, Upkeep, or Assistance." This standard is usually consisted of in depend on arrangements to direct the trustee on how they can distribute funds to beneficiaries. By adhering to the HEMS requirement, the count on guarantees that distributions are made for important demands and long-term assistance, protecting the trust fund's assets while still attending to member of the family.

Enhanced Flexibility: Unlike inflexible financial institution lendings, you regulate the payment terms when borrowing from your very own plan. This permits you to structure settlements in a method that straightens with your business cash money flow. infinite banking concept pdf. Improved Money Flow: By funding company expenses with plan loans, you can potentially maximize cash that would certainly or else be locked up in conventional financing settlements or devices leases

He has the exact same devices, but has actually also constructed extra money worth in his policy and got tax benefits. And also, he now has $50,000 readily available in his plan to use for future opportunities or expenditures., it's vital to watch it as more than just life insurance coverage.

Wealth Nation Infinite Banking

It's about creating a flexible funding system that gives you control and gives several benefits. When made use of purposefully, it can complement other financial investments and service strategies. If you're interested by the possibility of the Infinite Banking Principle for your company, here are some steps to think about: Inform Yourself: Dive deeper right into the principle with respectable publications, seminars, or appointments with knowledgeable specialists.

Latest Posts

Your Family Bank - Become Your Own Bank - Plano, Tx

Infinite Banking Definition

Infinite Banking Insurance Companies