All Categories

Featured

Table of Contents

For a lot of individuals, the biggest problem with the unlimited banking principle is that first hit to early liquidity caused by the costs. Although this disadvantage of unlimited financial can be reduced significantly with correct policy style, the initial years will certainly constantly be the most awful years with any type of Whole Life policy.

That said, there are certain boundless financial life insurance policy plans made mostly for high very early cash worth (HECV) of over 90% in the first year. However, the lasting performance will often significantly lag the best-performing Infinite Banking life insurance policy plans. Having accessibility to that extra four numbers in the first couple of years may come with the cost of 6-figures in the future.

You actually obtain some substantial long-term benefits that aid you redeem these early costs and after that some. We find that this prevented early liquidity problem with unlimited financial is a lot more psychological than anything else once thoroughly discovered. If they definitely needed every cent of the cash missing from their unlimited banking life insurance coverage policy in the first few years.

Tag: limitless financial idea In this episode, I speak regarding funds with Mary Jo Irmen that instructs the Infinite Financial Concept. This topic might be controversial, but I intend to get varied sights on the show and discover different approaches for ranch financial monitoring. A few of you may agree and others will not, but Mary Jo brings an actually... With the surge of TikTok as an information-sharing platform, financial recommendations and strategies have actually found an unique way of dispersing. One such approach that has been making the rounds is the unlimited banking concept, or IBC for brief, gathering recommendations from celebrities like rap artist Waka Flocka Flame. However, while the approach is currently preferred, its origins trace back to the 1980s when economist Nelson Nash presented it to the globe.

Within these plans, the money value expands based on a rate established by the insurer. As soon as a significant cash worth collects, insurance holders can obtain a cash money value lending. These car loans vary from traditional ones, with life insurance policy acting as collateral, meaning one might shed their insurance coverage if loaning excessively without appropriate cash value to support the insurance coverage prices.

And while the attraction of these plans appears, there are innate limitations and threats, requiring persistent money value tracking. The technique's legitimacy isn't black and white. For high-net-worth individuals or service owners, specifically those making use of strategies like company-owned life insurance policy (COLI), the advantages of tax breaks and substance development can be appealing.

How To Use Life Insurance As A Bank

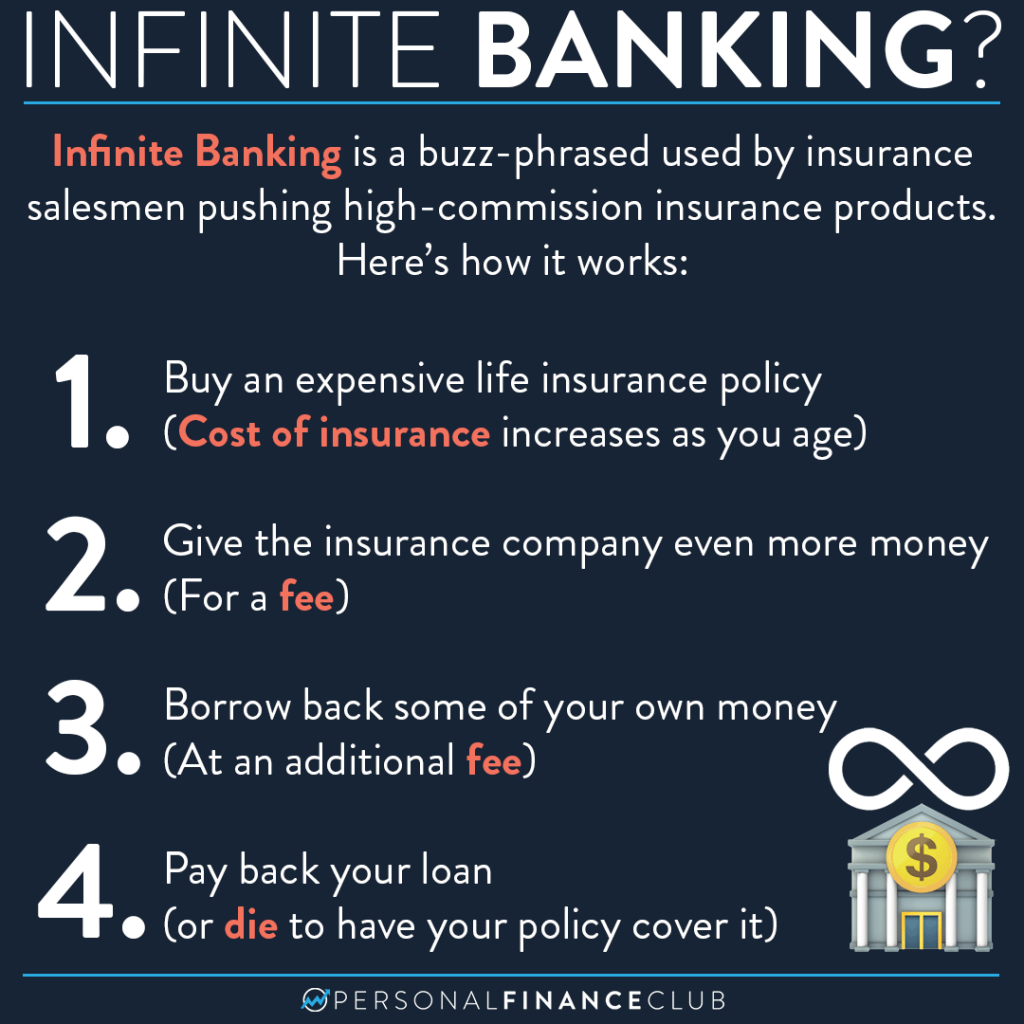

The attraction of boundless financial does not negate its challenges: Expense: The foundational demand, a permanent life insurance policy plan, is costlier than its term equivalents. Eligibility: Not everybody gets entire life insurance as a result of extensive underwriting processes that can leave out those with certain wellness or way of life conditions. Complexity and threat: The intricate nature of IBC, combined with its dangers, might deter several, particularly when easier and much less risky options are available.

Allocating around 10% of your monthly earnings to the policy is just not possible for most people. Component of what you read below is simply a reiteration of what has currently been stated over.

So prior to you obtain into a situation you're not prepared for, know the following first: Although the concept is typically marketed as such, you're not actually taking a finance from on your own. If that were the case, you would not need to repay it. Rather, you're obtaining from the insurer and have to settle it with interest.

Some social networks articles advise making use of money value from entire life insurance policy to pay for bank card financial obligation. The concept is that when you pay off the funding with passion, the amount will be sent out back to your investments. That's not just how it functions. When you repay the car loan, a section of that rate of interest mosts likely to the insurance provider.

For the initial several years, you'll be paying off the compensation. This makes it incredibly hard for your policy to accumulate worth throughout this time. Whole life insurance expenses 5 to 15 times extra than term insurance policy. Many people simply can not afford it. Unless you can afford to pay a few to several hundred bucks for the following decade or even more, IBC will not work for you.

Self Banking Whole Life Insurance

If you need life insurance policy, right here are some important ideas to think about: Consider term life insurance coverage. Make certain to go shopping about for the best rate.

Copyright (c) 2023, Intercom, Inc. () with Reserved Font Style Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Reserved Typeface Name "Montserrat".

Infinitebanking.org

As a certified public accountant concentrating on realty investing, I have actually combed shoulders with the "Infinite Financial Principle" (IBC) extra times than I can count. I have actually also interviewed professionals on the topic. The primary draw, other than the noticeable life insurance coverage advantages, was constantly the concept of constructing up cash value within a permanent life insurance coverage policy and borrowing against it.

Certain, that makes good sense. Truthfully, I always thought that cash would certainly be better invested directly on financial investments rather than channeling it via a life insurance plan Until I discovered how IBC might be integrated with an Irrevocable Life Insurance Trust (ILIT) to produce generational wide range. Allow's start with the essentials.

How To Create Your Own Bank

When you obtain against your plan's money value, there's no set settlement routine, giving you the flexibility to handle the financing on your terms. Meanwhile, the money worth proceeds to expand based upon the plan's warranties and rewards. This configuration enables you to access liquidity without interrupting the long-lasting growth of your policy, provided that the car loan and rate of interest are managed carefully.

The procedure proceeds with future generations. As grandchildren are born and grow up, the ILIT can buy life insurance policy policies on their lives as well. The trust then accumulates several policies, each with growing cash money values and survivor benefit. With these plans in place, the ILIT effectively comes to be a "Family members Financial institution." Family participants can take car loans from the ILIT, using the cash value of the plans to fund financial investments, begin businesses, or cover major expenditures.

A vital aspect of handling this Family Bank is making use of the HEMS requirement, which means "Wellness, Education And Learning, Upkeep, or Support." This guideline is typically included in trust arrangements to route the trustee on exactly how they can disperse funds to recipients. By sticking to the HEMS requirement, the count on ensures that circulations are made for vital needs and long-term assistance, guarding the depend on's assets while still offering member of the family.

Raised Flexibility: Unlike inflexible bank fundings, you regulate the settlement terms when borrowing from your own policy. This permits you to structure repayments in a means that straightens with your organization capital. ibc be your own bank. Improved Capital: By funding overhead with plan finances, you can possibly liberate cash money that would or else be locked up in typical funding settlements or tools leases

He has the same equipment, yet has actually additionally constructed additional cash money worth in his plan and received tax advantages. And also, he now has $50,000 readily available in his plan to use for future possibilities or costs., it's vital to watch it as more than simply life insurance coverage.

Your Own Banking System

It's about developing a versatile funding system that gives you control and provides numerous advantages. When utilized strategically, it can enhance other financial investments and organization methods. If you're interested by the potential of the Infinite Banking Concept for your service, here are some steps to think about: Enlighten Yourself: Dive much deeper right into the concept with reliable books, workshops, or assessments with knowledgeable professionals.

Latest Posts

Your Family Bank - Become Your Own Bank - Plano, Tx

Infinite Banking Definition

Infinite Banking Insurance Companies